In 2021 they were the calls that made any real estate agent want to slam their head against the wall: "I need an AirBnB property downtown, under $300,000. Move-in ready."

Too much Youtube and incredibly low interest rates made anyone and everyone a real estate "AirBnB investor." Total short-term rental supply hit 1.38 million listings this September, up 23% compared to last year and 62% of all active listings were added since 2020 alone. The result, both here in Wilmington and across the country, was a highly saturated market now having to embrace vacancies and price drops.

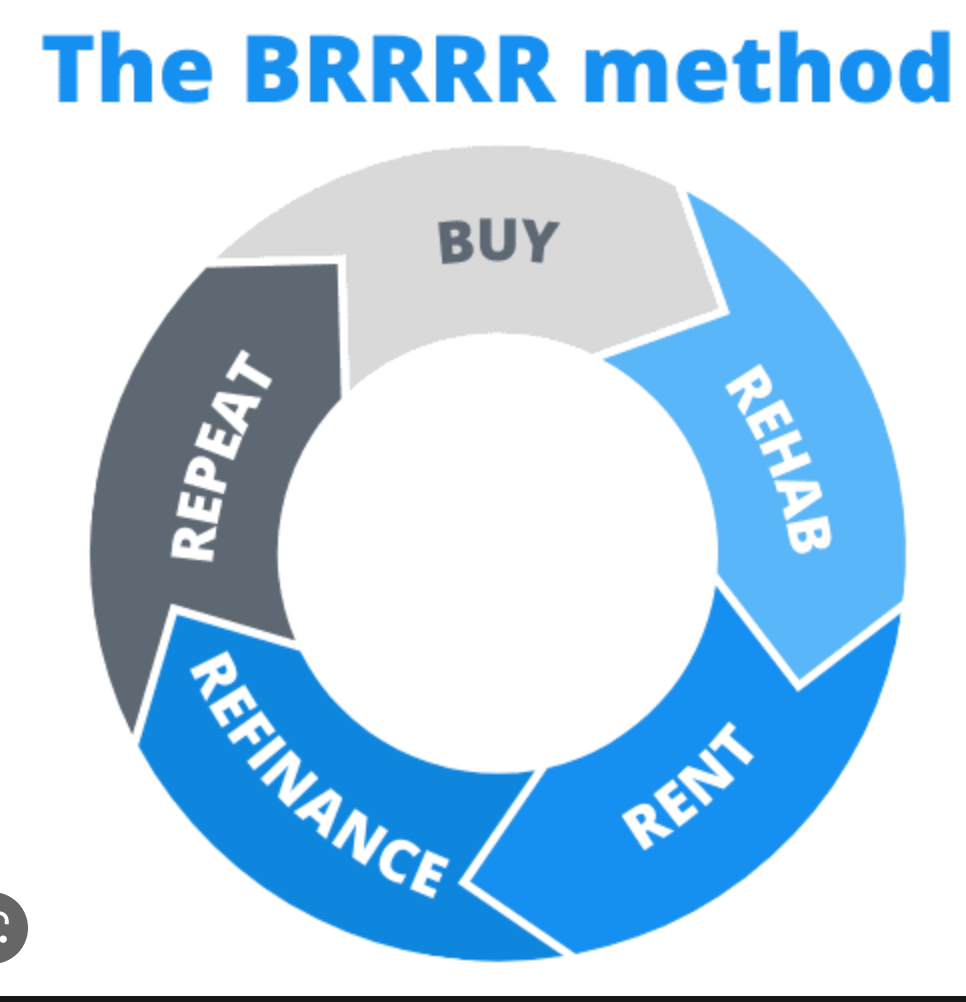

Airbnbs in great locations will always do well but their profitability now has to be balanced against higher rates and two years of meteoric price appreciation. With the stock market looking far from appetizing and short-term rentals softening, it's time revisit some of the less sexy but tried and true means of investing. Like BRRRR:

Buy. Rehab. Rent. Refinance. Repeat.

Right now the hardest property to sell is one that needs work. Buyers have been punched in the teeth for two years with multiple offers. Now they're getting punched and robbed with prices + rates. They are almost universally averse to doing repairs. They don't want to paint, they don't even want to wipe off the counter. At least not at that monthly payment. These properties are sitting longer which is where your opportunity is.

Step One: Buy

Get out your calculator. You will need to estimate the cost of renovations, monthly rental expenses and profit margins. Some investors use the "70% rule" which says that an investor should spend no more than 70% of a property's After Repair Value (ARV). The ARV is an estimate of the final value after all repairs are done. This is far from precise but gives a good starting point to allow for a 30% profit margin and room for unforeseen expenses.

Step Two: Rehab

Make the home liveable and marketable - don't go overboard on upgrades. A new roof, a modern kitchen, fresh paint and updated bathrooms will give you your highest ROI. ADD BEDROOMS wherever possible. Homes built decades ago often have redundant dens, dining rooms, play rooms and other areas that are better served as a bedroom to command a higher rent and future sales price.

Step Three: Rent

Where landlords go wrong is usually in the screening process. Don't skip background checks and references. Have a handyman on standby or hire a property management company. After all that work you'll be eager to get your first rent check but one bad tenant can undo months of effort and investment and stall the next part.

Step Four: Refinance

Here's how you get your money back. Go to the bank or lender with your updated property, a much higher appraisal and proof of steady rental income. By refinancing you will be able to "pull out" some or all of your money and start the process again and invest elsewhere. Typically there is a "seasoning" period" where a lender requires you own and manage the property for a certain amount of time before they'll refinance. It's best to identify a lender early on in this process. The refinance will be done at your new appraised value and if you've done everything right that's more money in your pocket.

Step Five: Repeat

Once you've cashed out from refinancing you can now buy another property and repeat the process again and again until you've built an empire. Every investor becomes more savvy as they go and usually gets a system and crew in place after their third or fourth, making the entire process easier and more profitable.

Here's an example (these numbers are not real):

Casey finds a fixer in Ogden for $200,000. She makes a $40,000 down payment with a $160,000 loan amount. She estimates $10,000 in new paint, windows and a vanity. After the work is done the new appraised value is $250,000 and she can rent it for $2,500. As its renting she waits a year and then refinances for 75% of the appraised value = $187,500. Casey pays off her original loan, takes the additional $27,500 and buys another fixer.

Casey, is a freakin' genius and is one property closer to funding her retirement.

Comments